Deciding to invest in new windows or doors can be a transformative step for your property, improving energy efficiency, comfort, and curb appeal. However, many homeowners wonder whether they’re required to pay a down payment before installation begins—and if so, how that impacts their budgeting and the overall project timeline. To better anticipate these details, it helps to understand how down payments function within the window and door replacement industry. For more detailed guidance on specific company policies, this Renewal by Andersen down payment overview offers further insights into common practices across major providers.

Down payments reflect a homeowner’s commitment and help contractors secure materials and schedule project time. It’s essential to discuss and document payment terms before signing any contract to avoid misunderstandings. Homeowners should also review local regulations, as many states limit how much contractors can collect upfront to protect consumers.

Understanding Down Payments in Home Improvement Projects

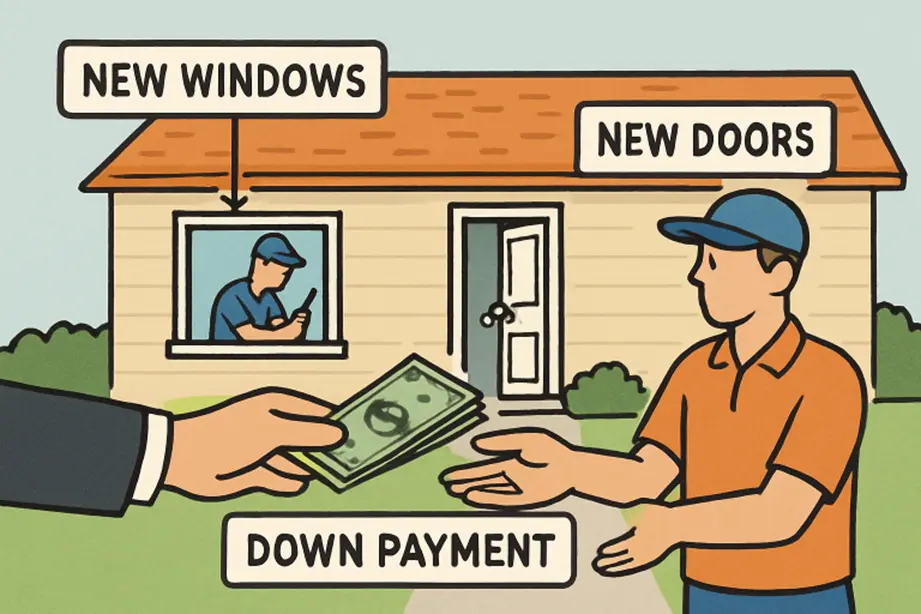

In window and door replacement work, a down payment is typically the first portion of your total bill paid after you sign the contract, but before the project begins. It serves several functions, such as ensuring both parties’ commitment and financial preparedness. According to Investopedia, a down payment is an initial, partial payment made to secure a purchase or agreement —an essential demonstration of good faith and intent.

- Project Commitment: A clear sign you’re serious about moving forward, which helps secure your slot in the contractor’s schedule.

- Resource Allocation: Allows the contractor to purchase materials specifically for your job and organize labor in advance.

Without this upfront exchange, contractors could be left exposed to costs if a client cancels at the last minute or delays payments after work starts.

Typical Down Payment Requirements

Down payment expectations can vary widely depending on the contractor, the project’s total value, and local legislation. You may encounter:

- Percentage-Based Payments: A common approach where the contractor requests a fixed percentage, usually between 10% to 50% of the total cost. For example, some companies in Las Vegas require a 50% down payment, with the remainder due upon completion.

- Fixed Dollar Amounts: Some businesses prefer to charge a flat fee that covers estimated material and labor costs.

It’s crucial that this, along with all aspects of your agreement, be outlined in a signed contract—including schedules, payment dates, and details about how the deposit will be used.

Financing Options and Down Payments

To attract more customers and accommodate a range of budgets, many window and door specialists offer competitive financing programs. Notably, these may affect or even eliminate standard down payment requirements. Two common options include:

- Zero Down Payment Plans: Qualified homeowners can begin their project with no upfront payment, making it possible to upgrade efficiency and appearance without waiting to save a large lump sum.

- Deferred or Low-Interest Financing: Options that may offer no or low interest for a promotional period if balances are paid off in time, benefiting homeowners seeking financial flexibility.

For reference, some providers promote $0 down and 0% interest plans for the first year, letting you spread costs out without the burden of immediate out-of-pocket expenses. Always read program terms carefully to understand long-term payment obligations.

State Regulations and Contractor Policies

Most U.S. states regulate how much a contractor can request as a down payment for home improvement work, often to protect homeowners from losing significant funds to unlicensed or fraudulent contractors. For instance, in California, state law limits down payments to 10% of the contract price or $1,000, whichever is lower. Always check your state’s website or a licensed contractor board for up-to-date rules. These protections shift the risk away from homeowners and support ethical business practices in the remodeling industry.

Benefits of Making a Down Payment

Though it does mean paying up front, making a down payment offers distinct advantages, such as:

- Securing Your Project: Ensures materials are ordered promptly and locks in your timeline.

- Smoother Execution: Gives contractors confidence to dedicate necessary resources and professional crews, often resulting in fewer delays or disputes.

Most reputable window and door installers provide receipts and documentation, which contributes to transparency and peace of mind for clients.

Alternatives to Down Payments

If putting down a significant deposit is a hardship, or if you’re wary of large upfront commitments, there are several viable alternatives:

- Financing Programs: Payment plans with little or no down payment help spread costs over several months or years.

- Home Equity Loans or Lines of Credit: Drawing on your home’s equity often secures favorable interest rates for substantial improvements.

- Government Incentives: For energy-efficient or security upgrades, homeowners may qualify for local, state, or federal grants and low-interest loans to offset costs.

Smart planning includes exploring such options before committing to terms that may strain your finances early in the process.

Conclusion

Understanding current norms and requirements for down payments is essential for planning your window or door replacement project. By researching local laws, comparing contractor policies, and evaluating financing alternatives, you can protect your interests and make strategic choices—ensuring the upgrade adds lasting value to your home and aligns with your financial goals.